AI story

When the Soviet Union launched the first human-made satellite Sputnik 1 into orbit in October 1957, it had an instant and profound effect on the American psyche and government policy. The event sparked widespread U.S. public anxiety about perceived Soviet technological superiority, with Americans following the satellite across the night sky and tuning in to Sputnik’s radio transmissions. It triggered the creation of the National Aeronautics and Space Administration (NASA), fueled major government subsidies for math and science education, and effectively launched the space race. That nationwide American mobilization bore fruit twelve years later when Neil Armstrong became the first person ever to set foot on the moon

AlphaGo scored its first high-profile victory in March 2016 during a five-game series against the legendary Korean player Lee Sedol, winning four to one. In May 2017, it continued to beat the Go champion – Ke Jie.

Machine learning—the umbrella term for the field that includes deep learning. Back in the mid-1950s, the pioneers of artificial intelligence set themselves an impossibly lofty but well-defined mission: to recreate human intelligence in a machine. That striking combination of the clarity of the goal and the complexity of the task would draw in some of the greatest minds in the emerging field of computer science: Marvin Minsky, John McCarthy, and Herbert Simon

Two camps: the “rule-based” approach and the “neural networks” approach.

Researchers in the rule-based camp (also sometimes called “symbolic systems” or “expert systems”) attempted to teach computers to think by encoding a series of logical rules: If X, then Y. This approach worked well for simple and well-defined games (“toy problems”) but fell apart when the universe of possible choices or moves expanded.

The “neural networks” camp, however, took a different approach. Instead of trying to teach the computer the rules that had been mastered by a human brain, these practitioners tried to reconstruct the human brain itself.

During the 1950s and 1960s, early versions of artificial neural networks yielded promising results and plenty of hype. But then in 1969, researchers from the rule-based camp pushed back, convincing many in the field that neural networks were unreliable and limited in their use. The neural networks approach quickly went out of fashion, and AI plunged into one of its first “winters” during the 1970s.

Current situation of AI in Vietnam:

Since 2014, AI has been included in the list of high-tech priorities for development investment in Vietnam. The Government has assigned the Ministry of Planning and Investment to develop a “National Strategy for the 4.0 Industrial Revolution”, identifying AI as one of the breakthrough and spearhead technologies that should be prioritized to focus on key groups. books to promote development. As a result, many national-level projects have been approved with the aim of bringing innovative and breakthrough technology ideas.

(Vietnam Law & Legal Forum 2021)

Major domestic technology corporations and innovative start-ups are accelerating their investments and making solid progress in AI research and application in many new business models. FPT, a well-known information technology services company in Vietnam, recently announced it will spend VND 300 billion ($13.16 million) on AI research and development over the next five years. This enterprise has invested in related research since 2013. Up to now, it has formed a diverse ecosystem of products, solutions and platforms to help other businesses optimize their operations and improve performance improvement, serving more than 14 million terminal users.

In an effort to realize the goal of becoming a national digital transformation leader, VNPT, a state-owned telecommunications enterprise, is promoting the development of AI technologies related to smart cities and e-government. Joining hands with localities, VNPT has deployed more than 30 intelligent operation and monitoring centers (IOCs) in provinces/cities nationwide, many of which have been put into operation.

Other technology corporations like Viettel, Vingroup are also spending heavily on AI research and development. To improve research capacity, Viettel and Vingroup have pioneered investments in supercomputer technology with the ability to perform over 20 million billion calculations per second to solve complex computational problems. While Vingroup focuses on technologies that apply AI in healthcare, smart cars and self-driving cars, Viettel focuses on investing in natural language processing technologies, converting Vietnamese voice and writing with high accuracy.

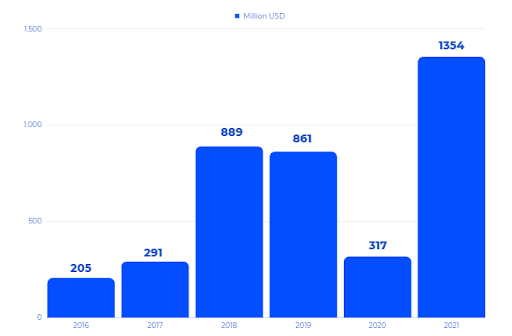

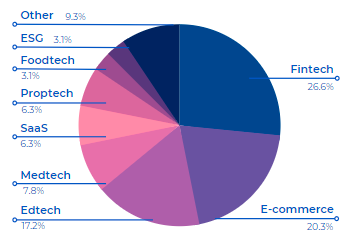

But not only large corporations are racing to AI, many Vietnamese startups or Vietnamese founders are also pursuing this field. Some have made their mark in the international market like ELSA Speak or Harrison-AI. Despite a sharp decrease from the previous year due to the impact of the COVID-19 pandemic, the investment capital in Vietnamese technology startups last year still reached more than 451 million USD, according to the Innovation and Public Investment Report. Technology Vietnam 2020. Many Vietnamese startups say that they have implemented or are considering implementing AI in their products in the future (Ministry of Industry and Trade of Vietnam 2021).

However, Vietnam’s AI has not really been developed to its full potential. Although AI is becoming an inevitable trend with great potential, the development of this field in Vietnam is facing significant challenges, such as limited human resources, data accuracy and firms’ access to capital.

Application of AI in Vietnam:

In recent years, a number of corporations, as well as the Government, have developed and applied artificial intelligence (AI) in a variety of industries, including education, telecommunications, retail, healthcare, and others, and have not only gradually controlled the market but also profited handsomely. The increase in the rate of AI adoption on a per-organization basis indicates rising interest in AI among businesses and industries. As reported, over 53% of surveyed organizations have put forth approximately $20 million each to invest in AI technology (VinAI 2022).

Some popular applications of AI in Vietnam are:

- Fintech industry. Not only banks, Fintech companies are also very interested in investing in AI applications. Most companies and startups launch AI products or have partial AI applications, showing that AI is no longer a trend but the future of the economy. Most recently, on June 30, 2021, MoMo, a digital payment startup announced the completion of the acquisition of all intellectual property rights of Pique, a provider of AI solutions. MoMo’s representative said that it will continue to recruit to triple the number of AI personnel related to data and data science, in order to transform MoMo into a truly AI-first company.

Previously, on June 25, 2021, Monfin application using AI algorithms to analyze user information and help these users better participate in financial and insurance products was officially launched. In December 2020, Zion Joint Stock Company (owner of Zalo Pay e-wallet) developed an AI product called Kiki for smart speakers after modeling the technologies of Siri (Apple) and Alexa (Amazon), etc. Along with IoT, the collection of data sources specific to each customer will help form a complete, up-to-date picture of customer needs. customer demand. When combined with AI solutions, fintech companies can fully proactively approach these changes in customer needs through the support of virtual assistants (Chatbots). Thus, in just an extremely short amount of time, possibly in seconds, fintech companies can give advice and recommendations that best suit customers’ needs or preferences right away. at the time they need it. This means that each customer will have a unique experience and receive advice tailored to their needs as quickly as possible. In addition, AI is a great tool to rank customer records, or recognize unusual transactions to help improve security more effectively for fintech (Bankingplus 2021).

- E-commerce industry. AI solutions help sellers create an optimal journey for each customer, from the moment they have a shopping need to the time they complete the order. At some major e-commerce platforms like Lazada, based on data collected and analyzed by an AI-integrated tool, sellers can record appropriate offers based on age, gender, region. From there, they can recommend the most suitable products, come up with a reasonable business strategy, and know when is the right time to launch a “flash sale” offer. “golden hour”… to stimulate the shopping needs of customers. Not only eliciting demand, AI also supports sellers to “close orders” quickly with the CEM – customer interaction management feature. This is a special feature that helps to classify customer files into target groups. Sellers can actively access each file directly to encourage customers to complete the order; reviews of purchased products; suggesting new products or advertising promotions at the booth… thereby increasing revenue and brand recognition. In addition, AI now has another effect that is promoting the “Diderot effect” – a term that describes the tendency of users to buy additional things to complement the product they have just purchased. Taking advantage of this effect, AI helps sellers suggest products that go with the main item, contributing to increasing sales. Mr. Joris Kroese, CEO and founder of Hatch (an enterprise specializing in providing technology solutions for e-commerce), affirmed that in the next decade, AI will continue to be an important factor determining determine success in enhancing the customer’s shopping experience; and at the same time effectively support in increasing sales for brands and retailers (VnExpress 2021a).

- Edtech industry. Currently, many educational institutions have been applying artificial intelligence (AI) to their management, renovating teaching methods and achieving initial results. Hong Bang International University has applied AI in face and voice recognition of students to serve for attendance purposes. FPT University even implements a deeper AI application when in addition to recognizing students’ faces, taking attendance, and managing students in the dormitory, the unit is also deploying AI in grading multiple-choice exams. Even more special is the research project “virtual teacher” applying ML (Machine learning) and AI (Artificial Intelligence) in Geography that teacher Le Van Anh and student Le Viet Dung (FPT High School) just announced, surprising many people by the efficiency and integration that AI brings. The “virtual teacher” will be used through two different, but linked areas: a chatbot and a video channel. Using chatbot will help users easily find information as well as ask questions related to the lesson for chatbot, users will get accurate information, in the shortest time (ETEP Vietnam 2020).

By applying AI in education, we expect that the future education will be tailored to each student’s needs and own capacity rather than a general model that teachers are trying to target a whole group like now (Baodautu 2021).

- Medical industry: Since the COVID-19 pandemic broke out nearly three years ago, the application of AI in healthcare in Vietnam has become a bright spot in the AI development plan. During the pandemic, large telecommunications corporations such as Viettel and FPT developed AI-applied chatbots to automatically statisticize the epidemic situation in Vietnam in the form of a real-time map. The number of people hospitalized in isolation, the number of people being treated and recovered are also continuously updated. In addition, AI is also used in other applications such as Bluezone, NCOVI to help detect cases of infection or early contact and send it to the authorities, helping the health sector to monitor the disease and have a timely response plan (Suc khoe & Doi song 2021).

Besides the significant support of AI in dealing with the pandemic, AI is currently being applied in 4 areas: disease diagnosis, treatment, health monitoring, information management and training, according to Dr. Tran Thi Mai Oanh, Director of the Institute of Strategy, Ministry of Health (VnExpress 2021). Specifically in disease diagnosis, the VinDr system, developed by the Big Data Research Institute (VinBigData), applies AI in image diagnosis of lung diseases on chest X-ray images and breast cancer diagnosis on images, which has been tested at 3 major hospitals in Vietnam (108, Medical University; Vinmec). 115 People’s Hospital, 115 Gia An Hospital in Ho Chi Minh City and Phu Tho Provincial General Hospital are also the first 3 hospitals to apply AI in stroke diagnosis and treatment, allowing the emergency treatment to open from the previous 6 hours up to 24 hours which greatly improves the patient’s chances of survival. In short, AI applications help improve the quality and efficiency of medical examination and treatment, overcome medical risks and incidents, and reduce the load on hospitals.

- Tourism Industry: With the help of AI, the tourism industry also creates many attractive new products. Technology application helps tourism units reduce time, human resources and production costs, thereby reducing service costs. For example, Da Nang – a tourism hub in the central region has coordinated with the Hekate Technology JSC to develop and pilot the first automatic tourism information searching and support channel via text message conversation in Vietnam called Chatbot Danang Fantasticity. The app helps holidaymakers easily check information: famous destinations, events, weather, ATM locations, and hotlines, etc and helps turn Da Nang into the second city in Southeast Asia to apply chatbot to tourism (VietnamPlus 2022). Another interesting AI application in the tourism industry is the facial recognition technology developed by VinAI Research Institute of Artificial Intelligence. It is implemented in Vinpearl to help minimize waiting time for procedures and moving processes between internal areas (Times 2019).

- Traffic: AI-supported traffic management projects were also initially applied in some metropolitan cities of Vietnam including Ha Noi, Ho Chi Minh City, Binh Duong, etc. One of the most noticeable AI applications in traffic is the Intelligent Transport System (ITS Solution) – a technology used to solve road traffic problems, including public security monitoring, traffic jam warning, current traffic violations, vehicle traffic counting system, etc. The system was first implemented in HCMC in 2019 with 5 main functions including Controlling the traffic signal system; Monitoring traffic situation; Providing online traffic information; Coordinating in handling violations of traffic order and safety, and Simulating traffic forecasting. In addition to the ITS Solution, Ho Chi Minh City also gradually builds a BMS solution, applying AI to improve efficiency in monitoring and managing the bus/route/passenger system. This solution package uses AI technology built on the foundation of technological solutions and devices such as information display LED panels at bus stations (bSmartLED), automatically analyze data and calculate the exact time the vehicle arrives at the pick-up/drop-off point (bSmartETA), digital map (bMap), navigation device (bGPS), AI Box device to help monitor passengers and drivers vehicle (bHub) and bus mapping software for passengers (ictvietnam.vn 2021).

- Infrastructure: The most salient infrastructure project focusing on enhancing AI research and application is the Hoa Lac hi-tech park. With the scale of 1.586 ha and a total capital of 450 million USD, this park is expected to become a science city, a place that attracts investors in the research & development field; training and incubation; manufacturing hi-tech products in the fields: Biotechnology, Information – communication technology, New material technology and Automation technology (Hoa Lac Hi-Tech Park 2021).

Support for AI Development in Vietnam:

In June 2021, the Prime Minister issued a national strategy on AI research, development and application until 2030. The strategy aims to “promote research, development and application of AI, making AI an important technology sector of Vietnam in the 4.0 Industrial Revolution”. Minister of Science and Technology Bui The Duy said the strategy targets that Vietnam will be among four leading countries in ASEAN and 50 nations globally in terms of AI research, development and application by 2030; build 10 prestigious AI trademarks in the region; and develop three national big data and high-performance computing centers (VietnamPlus 2021).

To promote research, development and application of AI, the Government of Vietnam has identified specific tasks and solutions to be implemented in the coming period as follows:

- Develop and complete additional legal documents on intellectual property rights related to artificial intelligence.

- Expanding projects to build community data in the form of the project of the Digital Vietnamese Knowledge System; connecting artificial intelligence and open science communities in Vietnam; supporting research mastery tasks, building domestic platforms for high-performance computing, cloud computing, fog computing; regularly organize activities to connect academic and research communities; professional community developing and applying artificial intelligence and data science at home and abroad.

- Strongly deploying public-private partnership, co-financing training centers, research and development centers and artificial intelligence application centers; invest in forming a number of key research groups on artificial intelligence and data science in a number of universities and public research institutes; invest in facilities for a number of key data science and data science laboratories in universities and public research institutes; promoting the construction of a number of data science innovation centers, forming a number of Vietnamese brands in data science in the world.

- Organizing basic research in data science, decoding technology, mastering technology, catching up with advances in data science, and initially contributing to data science method development new in a number of research institutions in mathematics and information technology; focus on investing in research and development of a number of artificial intelligence products based on data sources and specific knowledge of Vietnam; implementing a national key research program on artificial intelligence associated with graduate student training; deploying research and development of a number of important artificial intelligence product and service delivery platforms such as natural language processing, computer vision, automated processes, artificial intelligence technologies based on on data, robotics and practice vehicles, in some data-ready fields,

- Promote the formation of open professional groups in the fields, allowing to shorten the time to complete research results; promote the sharing, sharing, openness of data, technology and application of artificial intelligence in a multi-disciplinary, interdisciplinary and cross-sectoral direction to accelerate the formation of results and improve output efficiency of research and development activities in other fields; extensive training of open platforms on data and artificial intelligence applications; promoting open source communities and forums on artificial intelligence; encourage enterprises to order research institutes and universities to research and develop specific artificial intelligence products of Vietnam.

- Organizing events on artificial intelligence; support domestic individuals and organizations to participate in international seminars, exhibitions and competitions on artificial intelligence; participate in organizing and implementing bilateral and multilateral scientific research cooperation programs and projects on artificial intelligence; Promote the development of artificial intelligence research cooperation facilities and centers; cooperation projects on technology transfer, exploitation of inventions and industrial property rights between Vietnamese enterprises and foreign enterprises in artificial intelligence; high-quality artificial intelligence training centers and programs serving domestic and global markets; exchange of experts, researchers, students of Vietnamese organizations and enterprises with foreign research and training organizations and artificial intelligence enterprises.

As a result of the State’s specific strategy for investing in AI, for the first time, Vietnam’s AI readiness score (51.82 out of 100) exceeds the global average (47.72). Vietnam rose 14 places last year in a global ranking for AI readiness to 62nd out of 160 countries and territories and rose one spot to sixth among ASEAN member nations (VnExpress 2022).

Challenges:

(rubikAI & Nexus Frontier Tech 2018)

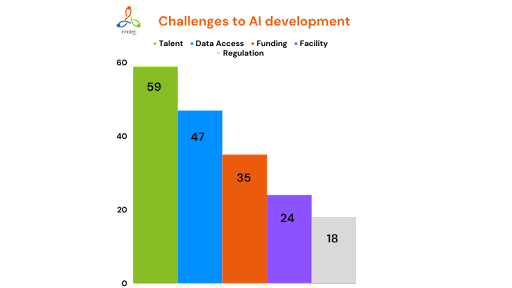

According to a research conducted by Nexus FrontierTech, rubikAI and G&H Ventures in 2018, the three biggest challenges with the development of artificial intelligence (AI) technology in Vietnam are talent shortage (59%), followed by limited data access (47%) and fundraising (35%) (rubikAI & Nexus Frontier Tech 2018).

Talent shortage. It is quite understandable because In the AI race, human resources are the decisive factor. Not only Vietnamese companies compete for the best Vietnamese AI engineers and researchers, but also international corporations and the world’s leading AI companies want to take advantage of this elite force. The participation of these companies is a good sign. It has created a momentum, attracting Vietnamese AI experts and engineers from all over the world. Regular seminars with the participation of foreign experts are helping to gradually form AI communities in the country (Ministry of Industry and Trade of Vietnam 2021).

Despite the thirst for talent in AI, the training of professional AI human resources in Vietnam is still weak and lacking. The main source of educating and providing high-quality AI human resources – Universities have claimed to encounter enormous difficulties in designing good enough Artificial Intelligence training programs. The first difficulty is the lack of lecturers – who have the experience and ability to design lectures that meet international standards with up-to-date and methodical content in both theory and practice. The second difficulty is that research groups in universities are lacking the minimal computational tools that allow them to develop and practice AI algorithms. According to Dr. Nguyen Phi Le – Executive Director of BK.AI Center under the University of Information and Communication Technology, “The AI industry requires a dedicated computer and server system with GPU graphics cards worth hundreds of millions of dong, usually only large enterprises can afford to invest.” (DNHN 2021)

Although universities are accelerating, they have even signed cooperation agreements with major technology partners from Korea, Japan, the US, Australia, etc in order to open international AI research centers in Vietnam, the speed and quality of training is also considered “difficult to keep up with demand” because the number of universities that actually train well in this field is only counted. on fingertips as well as the aforementioned entry barriers to access AI in Vietnamese universities.

The lack of human resources in the AI industry is so severe that even training IT human resources, which is considered an “outside” for the development and application of new digital technologies, is still short of 100,000-200,000 people per year. According to the report of Nexus FrontierTech in 2019, Vietnam’s AI human resources currently only meet 1/10 of the market demand. In an AI talk at the end of 2020, Prof. Ho Tu Bao, an expert in research and consulting on AI implementation in Vietnam, said that in fact, the number of human resources to understand algorithms and create AI tools only accounts for 2-3%, while the majority of 70-80% are those who use that tool to apply in professional fields (finance, insurance, healthcare, information, manufacturing, manufacturing, retail, services…).

Limited data access. An important obstacle that Vietnam needs to overcome is building data and computing infrastructure. AI is a data-driven field, therefore, without good and regularly updated data, we will be at a dead end. Meanwhile, the computing infrastructure that is the “machine” for AI to run is also very important, because as the speed of AI development and application increases, the amount of computation and resources for computation must also increase accordingly.

Vietnam’s data and computing infrastructure is still in its infancy. Vietnam does not have many good quality datasets; The data is often fragmented, less connected and limited in terms of access. Talking about the AI Strategy, Deputy Minister of Science and Technology Bui The Duy affirmed that in order to well implement the set goals, Vietnam needs to quickly form a culture of data sharing and open access.

The Government of Vietnam’s efforts to promote data sharing and centralization have been demonstrated through the launch of the National Data Portal (data.gov.vn) to share data from ministries, sectors and localities; as well as establishing a digitized Vietnamese Knowledge System to collect data from the community, label and preprocess that data to apply for artificial intelligence.

However, for AI to be researched and applied more widely, the culture of sharing, connecting and opening needs to spread to the whole business sector. Vingroup is pioneering when opening a dataset of 18,000 X-ray images collected and labeled by reputable radiologists. Soon, they open-sourced the labeling software so that research groups or startups can quickly develop their own math problems on medical AI. According to the technology development communities, such willingness to share data is valuable and should strengthen across more areas.

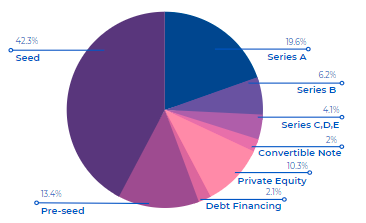

Fundraising. According to the AI landscape report of rubikAI (2018), AI businesses also face many difficulties when starting a business, with 59% of companies established under 2 years and only 34% raising more than $ 200,000 in capital from outside.

Most AI companies are still in the early stages, so the scale is relatively small, accounting for 68% of companies with less than 50 employees and 70% of companies with less than 10 AI engineers. Therefore, corporations and venture capital investors are important partners that can support in terms of capital, access to big data as well as market access.

AI popular startups/companies in Vietnam:

According to Mr. Nguyen Chi Dung – Head of Ministry of Planning and Investment Vietnam, AI has strongly developed. In 2018, the AI industry increased more than 70% compared to 2017 equalling to approximately USD 200 billion. AI has the potential to become the most disruptive and breakthrough technology within the next 10 years and we need to further promote its potential (VietnamCredit 2021).

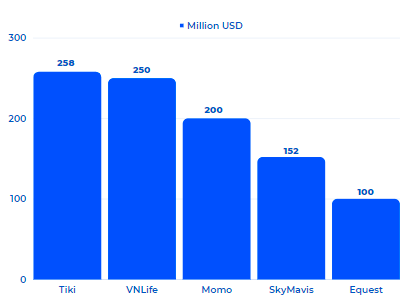

Some of the most AI popular startups/companies in Vietnam are (Tracxn 2022; TPS 2022):

VNLIFE

VNLIFE is an omnichannel banking and distribution software solution. It provides banks with technologies that allow them to deliver digital banking services to their consumers. It implements digital banking channels, payments, and solutions for travel and retail organizations using a variety of technologies such as AI, blockchain, IoT, and big data.

FPT AI

FPT AI is a subsidiary of FPT Software, a renowned worldwide technology, outsourcing, and IT services company based in Vietnam. The FPT.AI Artificial Intelligence Platform, developed by a team of top AI developers and specialists at FPT, offers tools to assist organizations to automate repetitive and sophisticated processes, improve operations, and deliver better customer service.

Zalo AI

Zalo AI is a subsidiary of Zalo, one of Vietnam’s largest tech firms. With an emphasis on Computer Vision, Speech Processing, Natural Language Processing, and Data Mining, the company has competence in virtual assistants and data analysis. Zalo AI has a huge database of 60 million active users in Vietnam thanks to social network Zalo. This gives them a huge advantage in developing and improving AI products and services.

VinAI

VinAI Research is a renowned research institute in Vietnam, with offices in Hanoi and Ho Chi Minh City. Its objective is to undertake high-impact research that pushes the knowledge frontier in AI and to expedite AI applications in Vietnam, the Asia Pacific region, and beyond. It is funded by VinGroup, Vietnam’s largest corporation by capitalization.

GRDAI – VNG

GRDAI R&D Department is funded by VNG Joint Stock Company. Founded in 2018 with the purpose of creating high-applicability artificial intelligence solutions. GRDAI’s products have received numerous honors in artificial intelligence competitions such as the Vietnam AI Grand Challenge and the National Grand Finale 2019.

Casting Asia

CastingAsia Platform, CastingAsia Marketplace, and CastingAsia Engagement are the 3 primary services offered by this firm, which was founded with the goal of offering data-driven insights to influencers. It’s all about ensuring that brands and influencers can market in a smart and secure manner.

DropDeck

Drop Deck ranks and evaluates all startups using AI algorithms. It earned recognition and support from world-class AI professionals as part of the IBM Watson AI Xprize competition.

Sero.ai

Sero.ai is a crop intelligence firm that uses full-cycle data analytics to optimize rice production. Sero.ai uses mobile internet to link farmers and agricultural specialists. Using photographs, the company monitors crop health and finds pests nearly quickly.

TINYpulse

Tinypulse was built to assist firms enhance employment retention by using NLP (neuro-linguistic programming) and sentiment analysis. Puget Sound magazine named the company one of the greatest places to work in 2017.

Sentifi

Sentifi, a Swiss fintech business, is a global leader in Crowd-Intelligence for financial markets. Sentifi’s big data and AI-based technology provides insightful research, allowing millions of investors to make smarter investment decisions by being better informed. Sentifi has won the Swiss FinTech Award for 2016.

Reference list

Bankingplus 2021, AI tăng sức mạnh cho các Fintech, Thời Báo Ngân Hàng.

Baodautu 2021, Ứng dụng rộng rãi trí tuệ nhân tạo trong giáo dục, baodautu, viewed 29 April 2022, <https://baodautu.vn/ung-dung-rong-rai-tri-tue-nhan-tao-trong-giao-duc-d154106.html>.

DNHN 2021, Những khó khăn trong việc đào tạo nhân lực AI tại Việt Nam, Tạp chí Doanhnghiephoinhap.vn – Cơ quan ngôn luận của hiệp hội Doanh nghiệp Vừa và nhỏ Việt Nam, viewed 25 April 2022, <https://doanhnghiephoinhap.vn/nhung-kho-khan-trong-viec-dao-tao-nhan-luc-ai-tai-viet-nam.html>.

ETEP Vietnam 2020, Đưa trí tuệ nhân tạo hỗ trợ giảng dạy: Xu hướng làm thay đổi phương thức giáo dục, etep.moet.gov.vn, viewed 29 April 2022, <https://etep.moet.gov.vn/tintuc/chitiet?Id=1258>.

Hoa Lac Hi-Tech Park 2021, Vision and mission, hhtp.gov.vn, viewed 25 April 2022, <http://hhtp.gov.vn/en/about/vision-and-mission-21.html>.

ictvietnam.vn 2021, Ứng dụng AI trong quản lý giao thông thông minh, ictvietnam.vn, viewed 25 April 2022, <https://ictvietnam.vn/ung-dung-ai-trong-quan-ly-giao-thong-thong-minh-20211207185216961.htm>.

Ministry of Industry and Trade of Vietnam 2021, Việt Nam đẩy mạnh đầu tư vào trí tuệ nhân tạo, Moit.gov.vn, viewed 25 April 2022, <https://moit.gov.vn/tin-tuc/phat-trien-cong-nghiep/viet-nam-day-manh-dau-tu-vao-tri-tue-nhan-tao.html>.

rubikAI & Nexus Frontier Tech 2018, Vietnam AI landscape report 2018, rubikAI.

Suc khoe & Doi song 2021, Cách mạng 4.0 và vị trí của AI trong y học, suckhoedoisong.vn, viewed 25 April 2022, <https://suckhoedoisong.vn/cach-mang-40-va-vi-tri-cua-ai-trong-y-hoc-169185679.htm>.

Times, V 2019, Vinpearl applies face-recognition technology in tourism, hotel industry in Vietnam, Vietnam Times.

TPS 2022, Top 8 AI Development Companies in Vietnam, TPSSOFT, viewed 29 April 2022, <https://www.tpssoft.com/blog/p/top-8-ai-development-companies-vietnam>.

Tracxn 2022, Artificial Intelligence Startups in Vietnam, tracxn.com.

Vietnam Law & Legal Forum 2021, National Strategy for Industry 4.0 introduced, vietnamlawmagazine.vn, viewed 25 April 2022, <https://vietnamlawmagazine.vn/national-strategy-for-industry-40-introduced-27590.html>.

VietnamCredit 2021, AI+companies+in+Vietnam, VietnamCredit, viewed 28 April 2022, <https://vietnamcredit.com.vn/news/ai-companies-in-vietnam_14347>.

VietnamPlus 2021, Vietnam looks to become AI hub in ASEAN by 2030 | Sci-Tech | Vietnam+ (VietnamPlus), VietnamPlus, viewed 25 April 2022, <https://en.vietnamplus.vn/vietnam-looks-to-become-ai-hub-in-asean-by-2030/205970.vnp>.

― 2022, AI application proves useful to improving tourists’ experience | Sci-Tech | Vietnam+ (VietnamPlus), VietnamPlus, viewed 25 April 2022, <https://en.vietnamplus.vn/ai-application-proves-useful-to-improving-tourists-experience/222478.vnp>.

VinAI 2022, How artificial intelligence is the key to unlock the future of humanity, VinAI, viewed 29 April 2022, <https://www.vinai.io/how-artificial-intelligence-is-the-key-to-unlock-the-future-of-humanity/>.

VnExpress 2021a, AI thay đổi trải nghiệm mua sắm online ra sao – VnExpress, vnexpress.net, viewed 29 April 2022, <https://vnexpress.net/ai-thay-doi-trai-nghiem-mua-sam-online-ra-sao-4336304.html>.

― 2021b, Việt Nam có lợi thế ứng dụng AI trong y tế, vnexpress.net, viewed 25 April 2022, <https://vnexpress.net/viet-nam-co-loi-the-ung-dung-ai-trong-y-te-4165932-tong-thuat.html>.

― 2022, Vietnam climbs 14 places in AI readiness ranking – VnExpress International, VnExpress International – Latest news, business, travel and analysis from Vietnam, viewed 25 April 2022, <https://e.vnexpress.net/news/news/vietnam-climbs-14-places-in-ai-readiness-ranking-4428352.html>.